How Much Money To Open A Vanguard Account

By Dr. James M. Dahle, WCI Founder

By Dr. James M. Dahle, WCI Founder

Brokerage business relationship. Not-qualified investing account. Taxable account. All of these are synonyms for the same affair. They are the opposite of a tax-protected business relationship, which is an umbrella term that includes tax-deferred accounts like 401(m)s and taxation-free accounts like Roth IRAs.

What Is a Brokerage Account?

When investing, it is helpful to think of an account similar a piece of luggage and an investment like a piece of article of clothing. Just like one type of luggage is better for some trips than others, one business relationship is ameliorate for a specific purpose than another account. But like any slice of clothing tin can go into any piece of luggage, (simply near) whatsoever given investment can get into whatever type of business relationship. A brokerage account is an business relationship created at a broker.

What Is a Broker?

A banker is but an intermediary betwixt you and the market. There are lots of brokers out in that location ranging from mutual fund companies similar Vanguard, Fidelity, or Schwab to "straight brokerages" similar eTrade, Robinhood, or WeBull that don't offer their ain investments.

Where Should You lot Open up a Brokerage Account?

My brokerage business relationship is at Vanguard. But I would not have any qualms any nigh opening one at Fidelity, Schwab, or eTrade, or TD Ameritrade. I would avert some of the newer ones, specially the ones that encourage frequent trading and speculative investing similar Robinhood or WeBull. You tin can open up a brokerage business relationship at whatsoever of these companies.

Why Should You lot Open a Brokerage Business relationship?

If you want to invest more for retirement than you tin can fit into tax-protected accounts like your 401(k) and Roth IRA, then you should do so in a brokerage account. If you desire to invest for something also retirement, you volition also desire to employ a brokerage account unless there is some other tax-protected account for that purpose such as:

- 529s for education

- HSAs for health care

- ABLE accounts for disabled children

Pros and Cons of Taxable Accounts

A taxable, non-qualified, brokerage account (future called a taxable business relationship for ease, although I suppose a taxable account also includes any investment outside of tax-protected accounts such as the gold in your safe or the rental habitation down the street) has many advantages and disadvantages.

Every bit you can see, the main advantage of a taxable business relationship is flexibility. The master disadvantage is that you usually pay more in taxation than if you lot were investing in a tax-protected account. These taxes reduce your return in the long run. The "tax-drag" (lower return) resulting from having the account taxed equally it grows is the principal reason why investing in taxation-protected accounts is improve if y'all can do information technology.

What Investments Should I Use in My Taxable Account?

As a general rule, if you accept opened a taxable business relationship at 1 of the brokers listed above, you lot are going to want to use very taxation-efficient common funds or exchange traded funds in that business relationship. Options frequently used by me and other white coat investors include:

- Vanguard Full Stock Market place Fund (or ETF)

- Vanguard Total International Stock Market Fund (or ETF)

- Vanguard Intermediate Municipal Bond Fund (or ETF)

The principal reason to use investments like these in your taxable account is that they are very taxation-efficient, and thus minimize the tax-drag that you experience in the account.

The process of placing your diverse nugget classes into your various accounts is called Asset Location, and how exactly it should be washed varies by person. You lot really demand to draft and follow a written investing plan. If you are besides invested in "alternative" investments like real estate, cryptocurrencies, commodities, or precious metals, yous too by and large invest in these in a non-qualified way—although these types of assets ofttimes cannot exist placed into the brokerage accounts at the recommended brokers above. You may need additional taxable accounts in order to invest in those types of avails, only like you would need a self-directed IRA or individual 401(k) to invest in those types of assets within tax-protected accounts.

Should I Use ETFs or Traditional Alphabetize Mutual Funds in My Brokerage Account?

Short respond: It doesn't thing.

Short respond: It doesn't thing.

Long answer: It still doesn't matter. At to the lowest degree not much. However, with some investments and some accounts, the fees can be higher with mutual funds than with ETFs. For example, if you lot try to buy Vanguard mutual funds in a Fidelity brokerage account, you will acquire that every transaction carries a $50 fee. But if you buy the same exact Vanguard mutual fund in its ETF format in that Fidelity account, yous won't pay any transaction fee at all.

Larn more near ETFs versus Mutual Funds here.

How to Open a Brokerage Business relationship at Vanguard: A Step-By-Step Guide

Let's say y'all have decided to open a brokerage and y'all want to do it at Vanguard. How do you actually open up an business relationship, fund it, and select investments for it? Let'southward take information technology footstep by step.

#1 Go to Vanguard.com

Simply click on "Open account" and it volition guide y'all through the process of opening an online account.

Click on the left side to open an account rather than transfer ane.

#two Fund the Account

Ordinarily, you're only going to link this new account to your checking business relationship.

Easy peasy.

#3 Make Sure You Have an Online Account

At this point, Vanguard needs you to have an online account.

If you lot already accept 1 (because yous have a Roth IRA or something), and then click on the right button. If yous don't, then click on the left button, set upwards your password and electronic mail and all that, and so return here for Pace #4. Information technology will tell you that you are going to demand the post-obit information:

Don't worry, nosotros'll walk you through information technology all together. Annotation that there could be a five concern day (i week) filibuster, so don't be surprised.

#four Provide Necessary Information

Now you lot simply have to click a few boxes.

Remember, even if y'all'll probably utilize the coin in this account for retirement, click the "general investing" button to open a taxable/brokerage account. If you click retirement, they'll try to help you open an IRA or Roth IRA. If it'south just for y'all, individual is the right push. If you're married, your spouse is going to appreciate you clicking that joint button. Unlike an IRA (which literally stands for INDIVIDUAL Retirement Arrangement), a taxable account can be individual or joint. Then hit continue.

#v Verify Data

The next two pages volition ask y'all to verify your information and provide your contact information.

#vi Financial Info

Now is where y'all link your bank business relationship and determine how much to move over.

#7 Select Investments

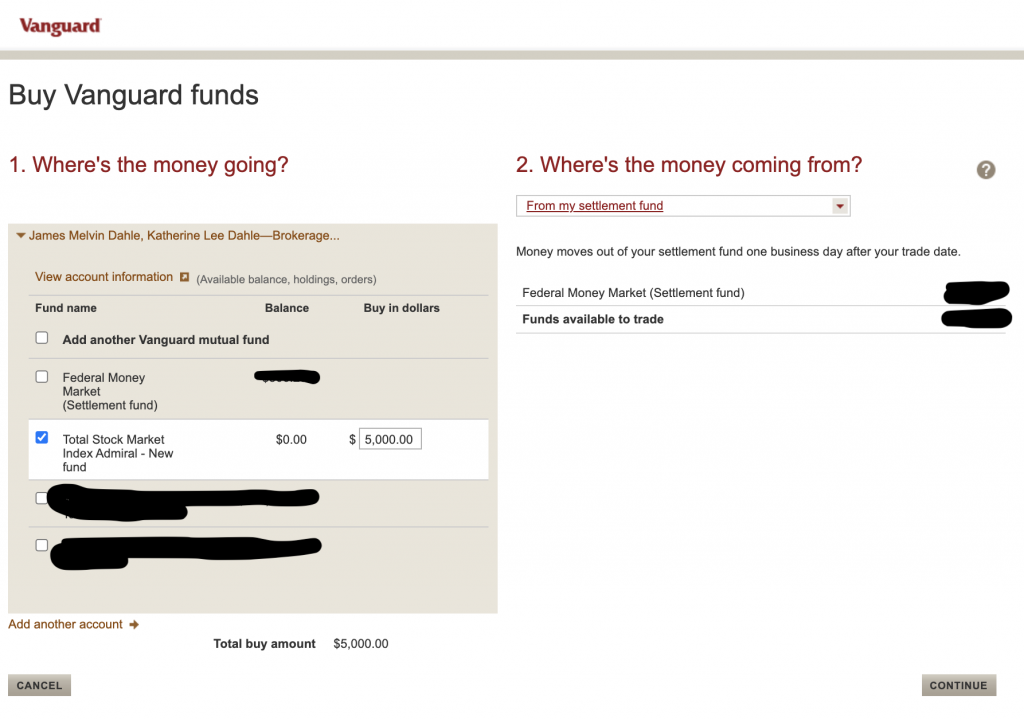

Once you take arranged to put money in there you can select your investments. This step looks the same as for an IRA. Y'all'll do this in the future too, just once you become to the page that lists the account, you lot should see something that looks like this. It may look a fiddling different with your first investment, of course.

Click on transact and a menu will drib down. If you're like almost, you'll be either buying Vanguard funds or trading Vanguard ETFs. Let's practice "buy funds" for at present.

Click "Add another Vanguard mutual fund." Put in the ticker symbol or name of what you lot want, and add the corporeality you lot want to add to information technology. I chose my favorite mutual fund in this case. Select where you want the money to come from (ordinarily settlement fund or your checking business relationship) and striking continue. Accept electronic receipt of your prospectus, review and submit the transaction and voila! You at present have a taxable account with an investment in it.

I hope you constitute this tutorial helpful. Let me know if yous accept any questions about information technology.

What do you think? Do you have a taxable brokerage account? Why or why not? Was this information and tutorial helpful? Comment below!

Source: https://www.whitecoatinvestor.com/how-to-open-a-brokerage-account/

Posted by: riversessfull1982.blogspot.com

0 Response to "How Much Money To Open A Vanguard Account"

Post a Comment